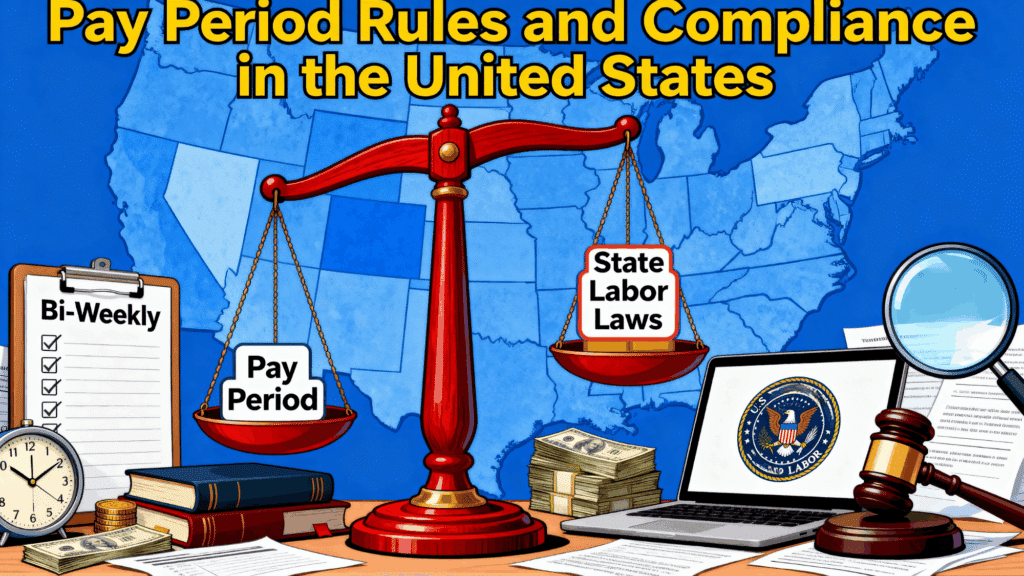

Getting paid on time is a right, but many workers face delays.

Most states require employers to pay within set timeframes, typically within 10 business days after the pay period ends.

So, how long can an employer delay payment before it’s illegal? It varies by state, but employers can’t withhold wages indefinitely.

This blog explains your legal rights, outlines when delayed payments can constitute wage theft, and provides guidance on what to do if your paycheck is late.

How Long Can an Employer Not Pay You?

The answer is that it is generally not very long, but this varies by state.

Even a delay of just one day can lead to penalties, such as a 5% fee each month and potential wage garnishment.

Most states require payment within 10-16 days after the end of a pay period, with some demanding even faster turnaround times.

Common state payment requirements:

- Weekly states – Wages due within 7 days (Rhode Island, Vermont)

- Bi-weekly allowable – Payment within 14 days of pay period end

- Semi-monthly standard – Twice per month on predetermined dates

- Monthly maximum – Most restrictive timeline, usually with 10-day grace periods

When Does Delay Become Wage Theft?

The line is crossed the moment payment is late, according to your state’s requirements. There’s no “acceptable” delay period.

Even a one-day default triggers legal violations and potential penalties.

The payment schedule varies by state. For example:

| State | Payment Schedule Requirement |

|---|---|

| New York | Manual workers must be paid weekly, within 7 days of the week. |

| Texas | Non-exempt employees must be paid at least twice monthly. |

| Illinois | Most employees must be paid semi-monthly, with exceptions. |

| California | Payment is required within 7 days of the pay period end, twice a month. |

Special timing rules apply for final paychecks

When employment ends, most states require immediate payment or payment by the next business day.

Some states allow employers up to 15 days to make a payment, but never longer than the next regular payday.

What to Do if Your Employer Is Late with Your Payment?

Don’t wait and hope the problem fixes itself. Late wage payments require immediate action to protect your rights and maximize your chances of receiving payment promptly.

Here’s your step-by-step action plan.

Step 1: Document Everything

Start by creating a paper trail right away. Keep records of:

- Original pay dates from employment agreements

- Actual payment dates and partial payments

- Written communications about delays

- Pay stubs and bank statements

- Screenshots of company pay policies

Proper documentation forms the foundation of any successful wage claim and protects your legal rights.

Step 2: Contact HR or Management Directly

Send a written notice via email to create documentation that you attempted to resolve the issue internally.

Include specific dates and amounts owed to establish a clear timeline and request immediate payment with a specific deadline.

Request written confirmation of when payment will be made, and copy your personal email to maintain records.

This professional approach often resolves issues quickly while creating necessary legal documentation.

Step 3: Know Your State’s Complaint Process

File with your state labor department because most states have online complaint systems that are free and relatively quick.

Contact the U.S. Department of Labor for federal wage violations when state remedies aren’t sufficient.

Use your state’s wage claim forms and meet filing deadlines, as most states require complaints within 2 years.

Missing these deadlines can permanently bar your right to recover unpaid wages.

Step 4: Gather Additional Evidence

Collect timesheets, work schedules, and email communications that prove hours worked and ongoing job duties during unpaid periods.

Gather witness statements from coworkers who experienced similar delays to show systematic violations.

Company policy documents and bank statements showing missed deposits provide clear evidence of violations.

Multiple types of evidence strengthen your case significantly and improve recovery chances.

Step 5: Calculate Total Amount Owed

Unpaid regular wages form the foundation of your claim and are calculated by multiplying your rate by the number of unpaid time periods.

Add statutory penalties of 5-10% per month and interest on delayed payments at state-specified rates.

Liquidated damages can potentially double your recovery under federal law and serve as punishment for willful violations.

These additional amounts can significantly increase your total recovery beyond base wages.

Remember: Acting quickly protects your rights and creates the strongest possible case for full recovery of your wages plus penalties.

Other Legal Actions in Case of Continued Delay in Payments

When employers ignore direct requests and state complaints, it’s time to escalate the issue.

Repeated payment delays show a pattern of wage theft that requires stronger legal action to protect your rights and recover what you’re owed.

1. Hire an Employment Attorney

An experienced wage attorney can significantly increase your recovery, often winning 2-3 times more than self-represented claimants.

Most work is done on a contingency basis, meaning there are no upfront fees. Lawyers can expedite employer responses and assist in recovering legal costs.

Retaliation claims and class actions can also boost your case.

2. File with Federal Agencies

The U.S. Department of Labor has enforcement powers that state agencies don’t, including investigations and back pay recovery programs.

Civil lawsuits filed by the DOL carry legal weight, and for willful wage theft, criminal referrals can lead to serious consequences for employers.

3. Pursue Small Claims or Civil Court

Small claims court is a quick and inexpensive option for resolving smaller wage disputes. With low fees and no attorney required, most cases are resolved in 2-3 months.

Judges can order immediate payment, making it effective for straightforward claims.

4. File Complaints with Multiple Agencies

Increase pressure on non-compliant employers by filing complaints with the State Attorney General, BBB, industry boards, and worker rights organizations.

Union reps can also assist with grievances for covered employees.

5. Consider Bankruptcy Implications

If your employer is in financial trouble, act quickly. Unpaid wages get priority in bankruptcy, but you must file promptly.

Bankruptcy law is complex, so professional advice is crucial. Alternative recovery methods, like personal guarantees, may still be viable.

Key Strategy: Use multiple approaches simultaneously. This detailed approach maximizes pressure on employers and increases your chances of full recovery.

Conclusion

Timely payment isn’t just a courtesy, it’s a legal requirement that protects workers from financial hardship.

By staying informed, documenting everything, and taking swift action, you can effectively defend your right to fair compensation.

If the issue remains unresolved, escalate it to state agencies or seek legal assistance.

Quick action boosts your chances of recovery and penalties.

Payment delays are considered violations from the start, with no grace period.

You’re entitled to more than base wages, as penalties and interest add up. Legal assistance often yields better results.

Protect your rights and recover what you’re owed. Share this with colleagues – someone may need it.

Frequently Asked Questions

Can My Employer Delay My Paycheck Due to Financial Problems?

No. Cash flow issues don’t give employers legal permission to delay wage payments. Employers must pay wages on schedule regardless of their financial situation.

What Happens if I Quit Before Getting My Final Paycheck?

Most states require final wages to be paid by your next regular payday or within 15 days of your departure, whichever comes first. Some states, like California, require immediate payment.

Can My Employer Make Partial Wage Payments Over Time?

No. Employers cannot split full wage payments into installments without your written agreement.

Partial payments may still trigger late payment penalties on the unpaid portion.

Do Overtime Wages Have Different Payment Deadlines than Regular Wages?

Federal law requires overtime wages to be paid on your next regular payday after the pay period in which the overtime was worked.