A demand letter initiates settlement negotiations by outlining your position, damages, and desired compensation to resolve disputes outside of court.

Wondering how long after the demand letter I can expect a settlement?

The answer depends on your case’s complexity, documentation completeness, insurance company cooperation, and negotiation dynamics, all of which we’ll explore in detail below.

Most settlements occur within 30-90 days after sending a demand letter, though complex cases may take 6-12 months.

Many factors influence how long after a demand letter I can expect settlement, and understanding these helps set realistic expectations.

What Is a Demand Letter?

A demand letter is a formal document that outlines your legal claim and requests specific compensation from the responsible party.

Key Components of a Demand Letter:

A well-written demand letter should include these essential elements to maximize your chances of successful settlement:

- Facts and Circumstances: State what happened, when, and who was involved. Include dates, locations, and witness information.

- Liability Explanation: Explain why the other party is responsible. Reference applicable laws or regulations.

- Damages Documentation: Detail all losses, including medical bills, property damage, and lost wages. Attach supporting documents.

- Demand Amount: State-specific compensation sought based on actual damages plus future costs.

- Response Deadline: Give a reasonable timeframe to respond, typically 30 days.

- Professional Tone: Maintain formal, factual tone. Avoid emotional language or threats.

Most effective demand letters are written by attorneys who understand legal requirements and negotiation strategies.

However, individuals can write their own demand letters for smaller claims by following these essential components.

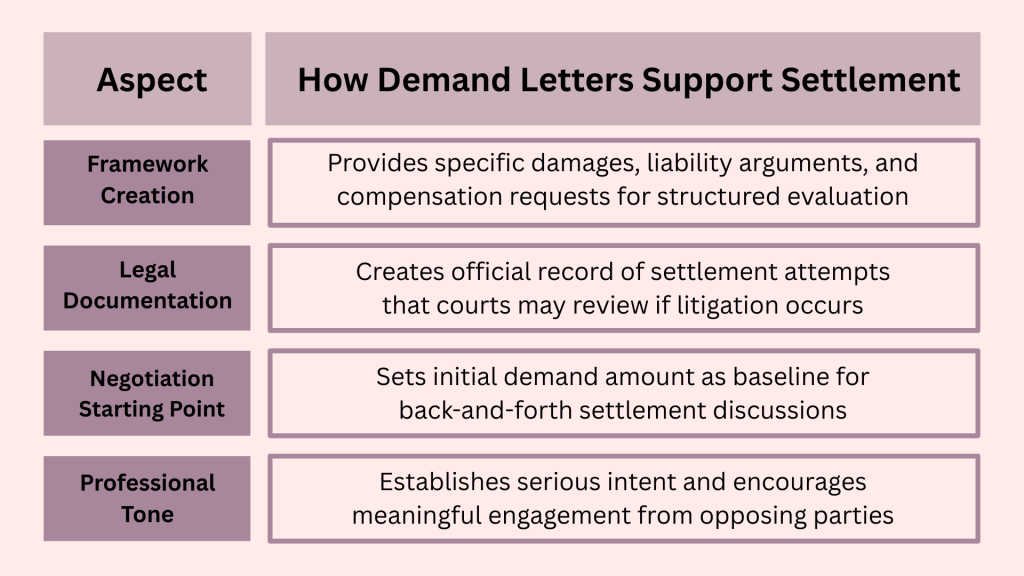

How Demand Letters Connect to Settlement Negotiations

A demand letter serves as the foundation for settlement discussions by formally communicating your legal position and desired resolution.

This document transforms a dispute from informal complaints into structured negotiations with clear parameters.

1. Establishing Settlement Framework

The demand letter outlines specific damages, liability arguments, and compensation requests, giving the opposing party concrete terms to evaluate.

Without this formal communication, settlement discussions often lack direction and focus.

2. Legal Significance

Demand letters create official records of settlement attempts, which courts may consider if litigation becomes necessary.

They demonstrate good faith efforts to resolve disputes outside the court system.

3. Setting Negotiation Baseline

Your demand amount becomes the starting point for negotiations.

Most settlements result in amounts below the initial demand, making the letter’s persuasive content and reasonable demand crucial for successful outcomes.

4. Professional Communication

Demand letters establish professional tone and serious intent, encouraging opposing parties to engage meaningfully rather than dismiss claims as casual complaints.

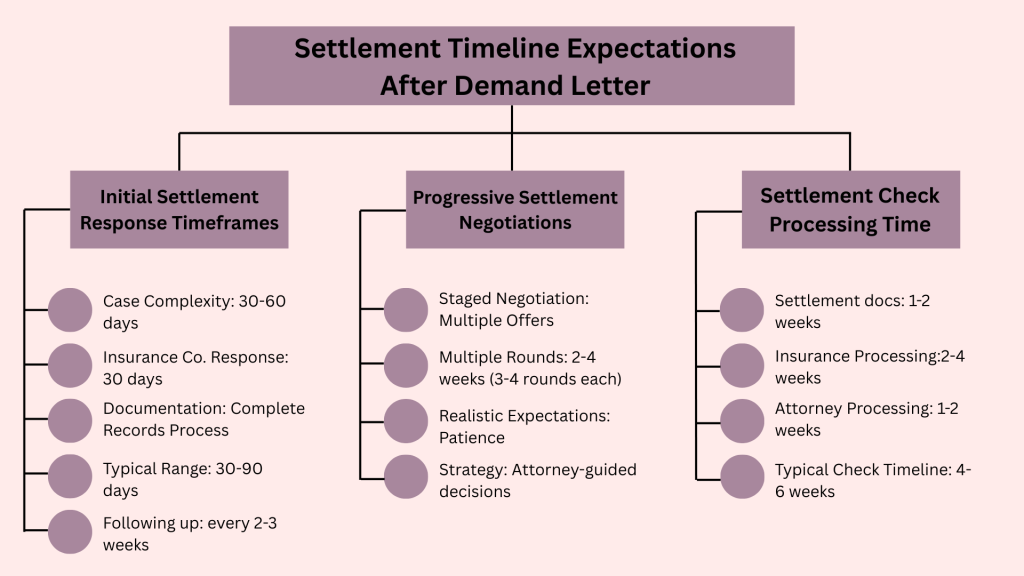

Settlement Timeline Expectations After Demand Letter

Understanding settlement timelines helps you plan and manage expectations throughout the negotiation process.

Settlement timeframes depend on various factors, from case complexity to insurance company responses, and can range from weeks to several months.

1. Initial Settlement Response Timeframes

Settlement timelines vary based on several key factors:

- Case Complexity: Simple claims resolve in 30-60 days, while complex cases can take several months.

- Insurance Company Response: Most insurers respond within 30 days, but investigation and approval can extend timelines.

- Parties Involved: Multiple defendants or coverage disputes take longer. Each additional party adds complexity.

- Documentation Requirements: Complete documentation speeds up the process, while missing records cause delays.

- Typical Timeline Range: Most settlements occur within 30-90 days, though some may take 6-12 months.

- Following Up Effectively: Professional follow-up every 2-3 weeks is appropriate, but avoid excessive pressure.

2. Progressive Settlement Negotiations

Progressive settlement refers to negotiations involving multiple rounds of offers and counteroffers.

- Staged Negotiation Process: Back-and-forth negotiations extend timelines but often result in better outcomes.

- Multiple Rounds Timeline: Each round adds 2-4 weeks. Cases requiring 3-4 rounds take 3-6 months to resolve.

- Realistic Expectations: Progressive cases require patience, but ongoing dialogue indicates genuine interest in resolution.

- Settlement Strategy: Your attorney will help determine when to counteroffer, stand firm, or accept the final offer.

3. Settlement Check Processing Time

Reaching an agreement is important, but several steps remain before you receive payment.

- Settlement Documentation: Preparing formal agreements typically takes 1-2 weeks, depending on complexity.

- Insurance Processing: Internal approval can take 2-4 weeks. Larger settlements may require additional approval.

- Attorney Processing: Your attorney will review documents and handle disbursement, adding 1-2 weeks.

- Typical Check Timeline: Most clients receive settlement checks within 4-6 weeks after agreement.

Factors That Influence Settlement Timelines

Several variables can significantly impact how quickly your case resolves:

- Case Complexity and Documentation: Well-documented cases with clear liability resolve faster. Complete medical records, police reports, and financial documentation speed up evaluation.

- Insurance Company Cooperation: Some insurers respond quickly and negotiate in good faith, while others may use delay tactics. The specific company can significantly affect timelines.

- Court Schedules: Cases involving litigation face additional delays due to court scheduling and discovery deadlines. Pending litigation can affect settlement negotiations.

- Claim Types: Personal injury claims typically take longer than property damage claims due to medical treatment completion. Contractual disputes may be resolved quickly if the facts are straightforward.

Tips to Speed Up Settlement

You can take several steps to help move your case forward more efficiently and reduce how long after a demand letter I can expect a settlement:

- Complete Documentation: Gather all medical records, bills, and supporting evidence early. Missing documentation is a common cause of settlement delays.

- Clear Communication: Respond promptly to your attorney’s requests for information. Quick responses keep negotiations moving forward.

- Reasonable Expectations: Understanding your case’s realistic value helps facilitate productive negotiations. Unreasonable demands can stall the process.

- Professional Representation: Experienced attorneys know how to present compelling demand letters and negotiate effectively with insurance companies.

Conclusion

Settlement timelines typically range from 30 days to several months, depending on case complexity and negotiation dynamics.

Progressive settlements take longer but may result in better outcomes.

Once you reach an agreement, expect your settlement check within 4-6 weeks after completing the required documentation.

Patience, combined with proactive communication, helps the process move smoothly.

Most cases resolve successfully through negotiation, saving time and expense compared to litigation.

Have questions about your settlement timeline or want to share your experience?

Leave a comment below, we’d love to hear from you.

Frequently Asked Questions

Can a Demand Letter Speed up Settlement Negotiations?

Yes, a well-crafted demand letter can expedite settlements by clearly presenting your case and supporting evidence, providing the opposing party with all the necessary information to make informed decisions.

What Happens if the Opposing Party Ignores the Demand Letter?

If there’s no response within 30-60 days, your attorney may send follow-up correspondence or consider filing a lawsuit to compel a response and protect your rights.

Are There Situations Where a Settlement Can Be Delayed Indefinitely After a Demand Letter?

While rare, significant delays can occur due to coverage disputes, bankruptcy proceedings, or multiple parties with competing interests. Most legitimate claims eventually resolve.