When you’re job hunting or trying to retain top talent, one question always comes up: What is competitive pay?

Simply put, it’s the kind of salary package that matches; or even exceeds; market standards for similar roles in your industry.

Competitive pay isn’t just about the numbers on a paycheck. It reflects how much a company values its employees, and it plays a significant role in both attracting candidates and retaining them.

For job seekers, knowing what counts as competitive pay helps you spot a fair offer.

For employers, it’s the key to building strong recruitment strategies and reducing turnover.

Here, we’ll look at what competitive pay means, how it stacks up against other compensation models, and practical strategies to make sure your salary (or offers) stay competitive in today’s market.

What is Competitive Pay in Employment?

Competitive pay in employment means salary and benefits that match or beat what other companies pay for similar jobs.

This type of pay is based on market research and industry standards rather than random amounts.

Companies use competitive pay to attract good workers and keep current employees happy.

When your pay is competitive, it means you earn what others with your skills and experience typically make in your area.

Competitive pay includes your base salary plus benefits like health insurance, retirement plans, and paid time off.

Key Factors that Define Competitive Pay

Competitive pay determination involves multiple variables that influence salary structures across different markets.

- Geographic Location: Urban markets offer higher competitive pay than rural areas due to cost-of-living differences.

- Industry Standards: Each sector maintains specific competitive pay benchmarks based on market demand and skill requirements.

- Company Size: Larger corporations typically provide higher competitive pay due to greater resources and market positioning.

- Experience Level: Senior professionals command premium competitive pay based on their expertise and track record.

- Education and Certifications: Advanced degrees and certifications increase competitive pay through specialized knowledge.

- Market Demand: High-demand roles with limited talent receive competitive pay premiums to attract candidates.

What Does Competitive Pay Include?

Competitive pay includes more than just a base salary.

It often encompasses bonuses and performance incentives that reward achievements and productivity.

Comprehensive benefits, such as health insurance, retirement plans, and paid time off, are also key components.

Some employers add perks like flexible work schedules, professional development opportunities, or wellness programs to enhance overall compensation.

By combining salary, benefits, and additional incentives, competitive pay ensures employees receive a total package that reflects their skills, contributions, and market value

Why Competitive Pay Matters in the Job Market?

Competitive pay serves as the foundation for successful talent acquisition and retention strategies.

Our research with Fortune companies shows that organizations offering competitive pay experience lower turnover rates and attract higher-quality candidates.

From an employee perspective, competitive pay ensures fair compensation aligned with market standards.

For employers, implementing competitive pay structures creates sustainable hiring advantages and improves employer branding.

The current job market demands that both parties understand competitive pay dynamics for successful employment relationships.

Competitive Wages vs Minimum Wage

Competitive wages differ substantially from minimum wage standards across multiple dimensions.

| Aspect | Competitive Wages | Minimum Wage |

|---|---|---|

| Purpose | Attract and retain top talent | Meet legal employment requirements |

| Market Position | Above industry average | Government-mandated floor |

| Employee Benefits | Comprehensive packages included | Basic benefits or none |

| Job Performance | Merit-based increases | Standard hourly rate |

| Employer Strategy | Talent acquisition advantage | Cost minimization approach |

| Career Growth | Professional development support | Limited advancement opportunities |

What Affects Competitive Pay?

Several factors influence competitive pay, determining how salaries are set in the job market.

- Location: Salaries differ based on the cost of living in various regions.

- Industry and job demand: High-demand fields or scarce skills often command higher pay.

- Company size and financial capacity: Larger organizations usually offer more competitive salaries.

- Experience, education, and specialized skills: Greater expertise and qualifications can increase earning potential.

- Market trends and economic conditions: Shifts in the economy and industry standards influence what is considered competitive pay.

Is Competitive Pay Weekly or Biweekly?

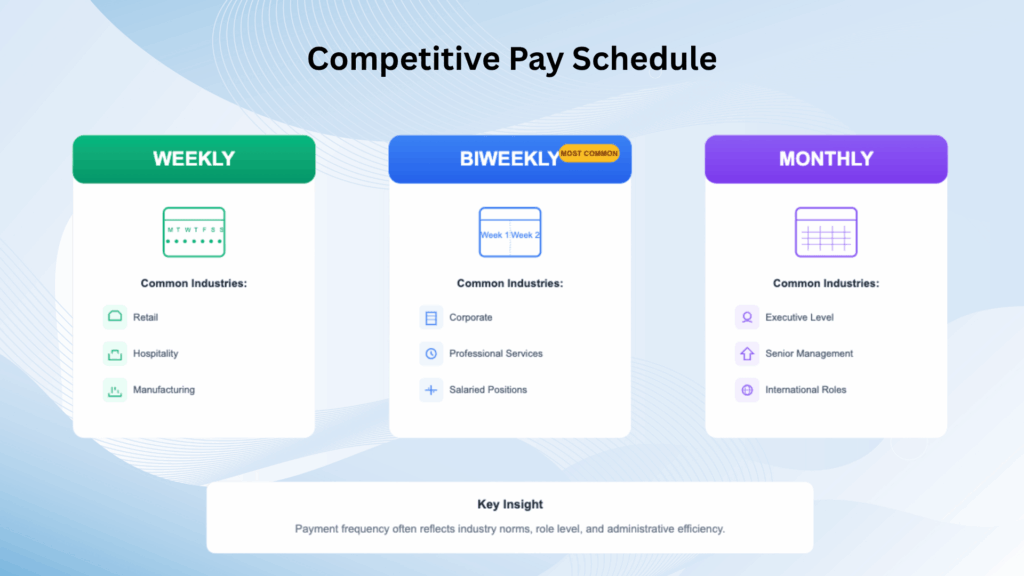

Competitive pay is typically biweekly, though it varies by industry and company.

Most professional organizations choose biweekly payment schedules as the standard, while weekly pay is common in retail, hospitality, and hourly positions.

1. Weekly Payment Schedules

Weekly competitive pay is common in industries requiring immediate cash flow for employees.

Retail, hospitality, and manufacturing sectors often implement weekly payment systems to support hourly workers who need more frequent access to their earnings.

2. Biweekly Payment Schedules

Biweekly competitive pay represents the most standard approach across corporate environments.

This schedule balances administrative efficiency with employee financial planning needs, making it preferred by most professional organizations and salaried positions.

3. Monthly Payment Schedules

Monthly competitive pay typically applies to executive and senior management positions.

This approach suits salary-based roles where employees manage larger financial responsibilities and longer-term budgeting cycles.

Competitive Pay vs. Other Compensation Models

Competitive pay exists within a broader compensation framework that includes various payment structures and benefit packages.

| Compensation Model | Structure | Competitiveness Factor | Best For |

|---|---|---|---|

| Salary-Based Pay | Fixed annual amount | Market benchmarking required | Professional roles with consistent responsibilities |

| Hourly Wage | Payment per hour worked | Varies by industry standards | Positions with variable work schedules |

| Commission-Based | Performance-driven earnings | High potential, high risk | Sales and revenue-generating roles |

| Benefits Package | Health, retirement, perks | Enhances total compensation | Full-time employees seeking stability |

| Bonus Structure | Performance incentives | Adds competitive advantage | Goal-oriented positions |

| Stock Options | Equity participation | Long-term competitive value | Startup and growth companies |

How to Negotiate Competitive Pay?

Competitive pay requires ongoing research and strategic planning from both employees and employers.

These practical steps help maintain market-aligned compensation standards.

- Research Industry Benchmarks- Use platforms like Glassdoor and PayScale to compare your salary against competitive pay standards.

- Evaluate Total Compensation- Consider benefits, bonuses, and perks alongside base salary when assessing competitive pay packages.

- Conduct Regular Market Analysis- Review competitive pay data annually to stay current with industry trends and changes.

- Document Performance Achievements- Track measurable results and accomplishments to justify competitive pay increases during negotiations.

- Seek Professional Development- Invest in skills and certifications that increase your value and support competitive pay advancement.

How Competitive Pay Influences Job Offer Decisions?

Competitive pay significantly impacts candidate decision-making processes during job offer evaluations.

Job seekers actively research competitive pay benchmarks using industry salary surveys before making career moves.

When employers present competitive pay packages, candidates show higher acceptance rates and faster decision timelines.

Competitive pay influences long-term job satisfaction and career commitment.

Companies maintaining competitive pay standards create positive workplace cultures and reduce recruitment costs.

Examples of Competitive-Paying Jobs

Examples of competitive-paying jobs span various industries where demand for skilled professionals is high.

- Roles in technology, such as software engineers and data analysts, often offer competitive pay due to specialized skills and market demand.

- Healthcare positions, including registered nurses and physical therapists, also provide salaries above average to attract qualified talent.

- In finance and business, investment bankers and financial analysts are commonly offered competitive pay packages.

- Even skilled trades, like electricians and plumbers, can receive competitive pay depending on experience and regional demand, reflecting the value of their expertise in the job market.

Conclusion

Competitive pay serves as the foundation for successful employment relationships in today’s market.

Competitive pay principles helps employees secure fair compensation while enabling employers to attract and retain top talent effectively.

The key to maintaining competitive pay lies in conducting regular market research, documenting performance, and implementing strategic career development.

If you’re negotiating your first job offer or reviewing company-wide compensation structures, competitive pay knowledge ensures informed decision-making.

Stay informed about competitive pay trends in your industry and take action to align your compensation with current market standards.

Start researching salary benchmarks today and position yourself for compensation success.

Comment below and share your thoughts.

Frequently Asked Questions

Is Competitive Pay a Good Thing?

Yes, competitive pay benefits both employees and employers by ensuring fair market-based compensation, improving job satisfaction, and reducing turnover rates.

How Do you Professionally Say that the Salary Is Not Enough?

Express concern by stating: “Based on market research and my qualifications, I believe the compensation could be adjusted to better reflect industry standards.”

When Not to Negotiate Salary?

Avoid salary negotiations during company financial difficulties, immediately after poor performance reviews, or when you lack market research and supporting data.