Your paycheck just got smaller, and your boss says it’s temporary. But can a company lower your pay without your consent?

The short answer is yes, but only under specific conditions.

Many employees are unaware of their legal protections against unfair pay cuts.

In this blog, you’ll find when pay cuts are legal, your rights under federal and state laws, and how to spot illegal reductions.

Knowing these rules can protect you from financial loss and workplace retaliation. Let’s break down what’s allowed and what crosses the line.

Can a Company Lower Your Pay?

Yes, employers are legally allowed to reduce your pay, but they must follow strict rules to ensure the reduction is lawful.

Most states permit pay cuts only for work that will be performed in the future, meaning your employer cannot retroactively reduce wages for hours you have already worked.

Additionally, employers are required to provide proper notice before implementing any changes to your salary.

When are Pay Cuts Legal?

Employers may lower pay during times of economic hardship or business restructuring as a way to maintain operations and avoid layoffs.

Performance-based pay reductions are also considered legal, provided they are clearly outlined in your employment contract and communicated in advance.

Key Requirements Employers Must Meet:

- Before any pay cut takes effect, your employer must notify you in writing. The reduction can only apply to future work and must never be retroactive.

- Employers must also treat all employees in similar positions equally, ensuring that pay cuts are implemented fairly across the workforce.

When do Pay Cuts Become Illegal?

Pay reductions cross the line into illegality when they target employees unfairly or violate federal protections.

For instance, federal law prohibits wage reductions that discriminate against employees based on protected characteristics such as race, gender, age, or disability.

Similarly, pay cuts taken in retaliation are illegal. Employers cannot use wage reductions to pressure employees into resigning or to punish them for exercising their rights.

Special Rules for Salaried Workers:

Exempt employees, who are typically salaried, enjoy additional protections.

Employers cannot reduce an exempt employee’s salary below $684 per week, and repeated pay reductions may violate overtime provisions.

Understanding these rules is crucial for salaried employees to ensure they are not being unfairly compensated.

Understanding Federal Wage Protections

The Fair Labor Standards Act (FLSA) serves as the foundation for wage protection in the United States.

This federal law requires employers to pay minimum wage and overtime and prohibits illegal deductions from paychecks.

The FLSA applies to most private employers as well as government agencies, providing a baseline level of protection for employees across the country.

Federal vs State Law Protection

While federal law sets minimum protections, many states provide stronger wage safeguards.

When state and federal law differ, employees benefit from the law that offers greater protection.

For example, California and New York require stricter notice before reducing pay, and some states mandate written agreements before wages can be lowered.

Employment Contracts vs At-Will Employment

The type of employment you have also affects how pay reductions can be applied.

Contract employees are entitled to the specific wage terms outlined in their agreements, and any violation may result in a breach of contract claim.

At-will employees have fewer protections regarding pay cuts, but this does not remove their right to be free from discrimination or retaliation.

Union Workers Get Extra Protection

Employees covered by collective bargaining agreements often receive additional safeguards against sudden pay reductions.

These contracts usually require negotiation and mutual agreement before any wage changes can be made, often superseding standard at-will employment rules.

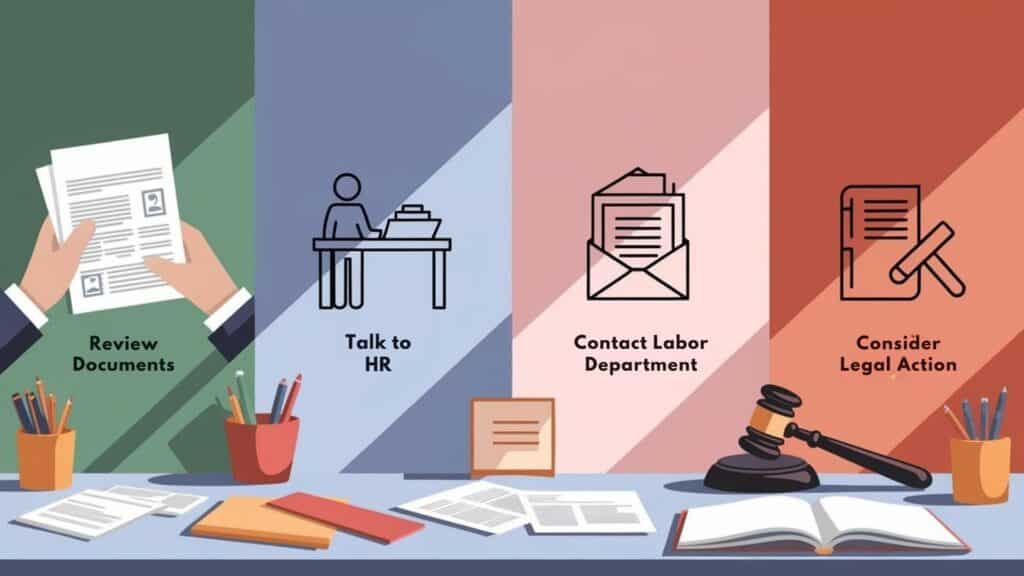

What to Do If Your Pay Gets Cut Illegally?

If you suspect your pay has been reduced unlawfully, it is important to act promptly and strategically.

Begin by documenting all information related to your pay cut, including emails, memos, written communications, and pay stubs, both before and after the reduction.

Step 1: Review Your Employment Documents

Carefully examine your employment contract, handbook, or any company policies that address pay changes.

Look for required notice periods, approval processes, or any internal procedures that your employer is obligated to follow before reducing wages.

Also, note any clauses that outline employee rights or dispute resolution processes, as these can guide your next actions.

Step 2: Talk to Your HR Department

File a formal complaint with Human Resources, requesting the pay cut decision in writing and asking for specific reasons and legal justification for the reduction.

Often, HR can reverse illegal pay cuts if the issue is properly raised and documented.

Keep a detailed record of all communications with HR, including dates, names, and the content of discussions, to support your case if needed.

Step 3: Contact the Department of Labor

If HR does not resolve the issue, you can file a wage complaint with your state’s labor department.

State agencies investigate wage violations at no cost and can require employers to pay back wages with interest.

In some cases, employees can also file complaints with the federal Department of Labor if state-level remedies are insufficient.

Step 4: Consider Legal Action

Employers who violate wage laws may face serious legal consequences. You may be entitled to recover back pay, penalties, and attorney fees.

Cases involving multiple employees can even evolve into class action lawsuits, which often result in larger settlements.

Many employment attorneys handle these cases on a contingency basis, meaning you pay nothing up front while pursuing your claim.

Advice: Keep working while pursuing your complaint, as quitting may harm your case. Document retaliation and consider joining coworkers facing similar pay cuts.

Conclusion

A company can lower your pay for reasons like economic hardship or restructuring, but must give notice and cannot discriminate or retaliate.

Legal protections, including the FLSA and state laws, prevent unfair pay cuts, with additional safeguards for contract and union workers.

If you face an illegal pay cut, document everything, file complaints with the Department of Labor, and seek legal advice.

Many wage violation cases result in the recovery of full back pay.

Worried about a suspicious pay reduction? Consult an employment lawyer, as many offer free consultations for wage violations.

Frequently Asked Questions

Is It Legal for Companies to Reduce Wages Below Minimum Wage?

No. Federal and state minimum wage laws always apply. Employers cannot reduce your pay below the minimum wage rate in your location, even during economic hardship.

What Advance Notice are Employers Required to Give Before Applying Pay Cuts?

Most states require advance notice before pay cuts take effect. The notice period varies by state; some require 24 hours, while others require one full pay period. Check your state’s specific requirements.

Can Employers Slash Pay Rates for Declining Overtime Shifts?

No, this would be illegal retaliation. Employers cannot cut your regular pay rate because you decline voluntary overtime work. However, you may lose overtime pay by working fewer hours.