A serious illness or injury can disrupt your career and finances in an instant.

Long-term disability (LTD) provides a crucial safety net when health conditions prevent you from working for extended periods.

Understanding how LTD works through your employer helps you prepare for unexpected situations.

It also helps you make informed decisions about your financial security.

This comprehensive resource walks you through the entire LTD experience.

From filing your initial claim to understanding your legal protections under the ADA and FMLA, we cover everything you need to know.

Most importantly, you’ll gain practical strategies for protecting your income and planning your eventual return to work.

How Long-Term Disability Affects Employment?

When an employee goes on long-term disability, their active work status is paused, and they begin receiving income replacement through the employer’s LTD plan.

During this period, job protections under laws like the ADA and FMLA may apply, benefits such as health insurance can continue with adjustments, and the employee’s role may shift to leave status until recovery or reassessment.

What is Long-Term Disability Insurance?

Long-term disability insurance is income protection that pays you monthly benefits when a serious illness or injury prevents you from working for an extended period.

It replaces 50-70% of your income and activates after a 90-180 day waiting period, providing coverage from a few years to retirement age.

Most employers offer both short-term disability (STD) and LTD coverage as part of their benefits package to provide complete income protection.

Short-Term vs Long-Term Disability

Understanding the key differences between these two types of disability coverage helps you plan for various scenarios and know what benefits to expect.

Short-term disability means: It covers immediate needs when you first become unable to work due to illness or injury. It serves as a bridge between your regular paycheck and longer-term solutions.

Long-term disability means: Long-term disability provides extended coverage for serious conditions that require months or years of recovery time. It activates after short-term benefits end and offers sustained financial support.

Here’s a quick comparison of the key differences:

| Feature | Short-Term Disability (STD) | Long-Term Disability (LTD) |

|---|---|---|

| Duration | A few weeks to several months | Several years to retirement age |

| Coverage Period | 13 weeks to 1 year | Begins after a 90-180 day waiting period |

| Income Replacement | 60-70% of salary | 50-70% of pre-disability income |

| Purpose | Initial disability coverage | Extended protection after STD ends |

Long-Term Disability Through Employer

Employer-provided LTD offers valuable income protection but comes with specific restrictions and exclusions.

Understanding these terms helps you know what to expect from your coverage.

Income Replacement: LTD benefits typically replace 50-70% of your pre-disability gross income, though benefits may be reduced by other income sources such as Social Security Disability Insurance (SSDI).

Benefit Duration: Coverage periods vary widely:

- Short-term disabilities: 2-5 years

- Long-term disabilities: Until age 65 or Social Security retirement age

- Permanent disabilities: Lifetime benefits in some cases

Cost-of-Living Adjustments: Some policies include annual increases to help benefits keep pace with inflation.

Continuation of Benefits: Many policies allow you to maintain health insurance coverage, though you may be responsible for premium payments.

Long-Term Disability Limitations

Understanding policy limitations helps set realistic expectations:

1. Pre-existing Condition Exclusions: In many organisations, the long-term disability policies exclude conditions that existed before coverage began, typically for 12-24 months.

2. Mental Health Limitations: Benefits for mental health conditions are often limited to 12-24 months unless the condition has an organic cause.

3. Substance Abuse Exclusions: Disabilities related to alcohol or drug abuse are typically excluded.

4. Self-Inflicted Injury Exclusions: Intentionally self-inflicted injuries are not covered.

5. Maximum Benefit Caps: Policies often include monthly and lifetime maximum benefit amounts.

6. Partial Disability Provisions: Some policies provide reduced benefits if you can work part-time or in a limited capacity.

Long-Term Disability Benefits Eligibility Requirements

To qualify for long-term disability benefits through your employer, you must meet several criteria:

1. Active Employment: You must be an active employee when the disability occurs, and some employers require a minimum employment period (90 days to six months) before LTD coverage becomes effective.

2. Elimination Period: You must satisfy the 90-180-day waiting period before LTD payments begin.

3. Medical Documentation: You need comprehensive documentation from licensed healthcare providers showing your condition prevents you from working, including test results, treatment records, and physician statements.

4. Own Occupation Standard: Initially (first 24 months), you cannot perform the material and substantial duties of your specific job, even with reasonable accommodations.

5. Any Occupation Standard: After 24 months, you cannot perform any gainful occupation for which you’re reasonably qualified by education, training, or experience.

Some policies also require that you be under the regular care of a physician and follow prescribed treatment plans to maintain eligibility.

Application Process for Filing for Long-Term Disability

Filing for long-term disability benefits involves a structured five-step process that requires coordination between you, your employer, healthcare providers, and the insurance company.

1. Notify Your Employer: Contact your HR department immediately when you need long-term disability benefits. Early notification ensures a smooth transition and prevents claim issues.

2. Complete Application Forms: Your employer or insurance company will provide application forms requiring information about your medical condition, work history, and relevant details.

3. Gather Medical Documentation: Work with healthcare providers to compile medical records, including diagnosis, treatment history, functional limitations, and recovery timeline.

4. Submit Your Claim: File your completed application with all documentation within 30-90 days of becoming disabled.

5. Review Process: The insurance company will review your claim through independent medical examinations, medical records requests, and functional capacity evaluations.

Job Status and Legal Rights During Long-Term Disability

When you go on long-term disability, your employment status changes significantly, but federal laws provide important protections against discrimination and wrongful termination.

Changes in Employment Status

When you go on long-term disability, your employment status undergoes several important changes:

- Leave Status: You’ll be placed on unpaid leave once paid time off and short-term disability benefits end. Your employment continues, but you’re not actively working.

- Role Modifications: Some employers offer modified duties or part-time work if your condition allows limited work capacity.

- Benefits Continuation: Many employers continue health insurance coverage during LTD leave. You may need to pay your portion of premiums.

Laws for Job Protection After Long-Term Disability

Several federal laws provide important protections for employees on long-term disability:

1. The Americans with Disabilities Act (ADA) prohibits discrimination against qualified individuals with disabilities and requires employers to provide reasonable accommodations.

Key protections include:

- Protection from disability-based discrimination

- Right to reasonable accommodations upon return

- Job protection during reasonable leave periods

2. The Family and Medical Leave Act (FMLA) provides eligible employees with up to 12 weeks of unpaid, job-protected leave for serious health conditions.

While FMLA leave is typically shorter than LTD periods, it provides additional job security during the initial disability period.

Return to Work After Long-Term Disability: What to Do?

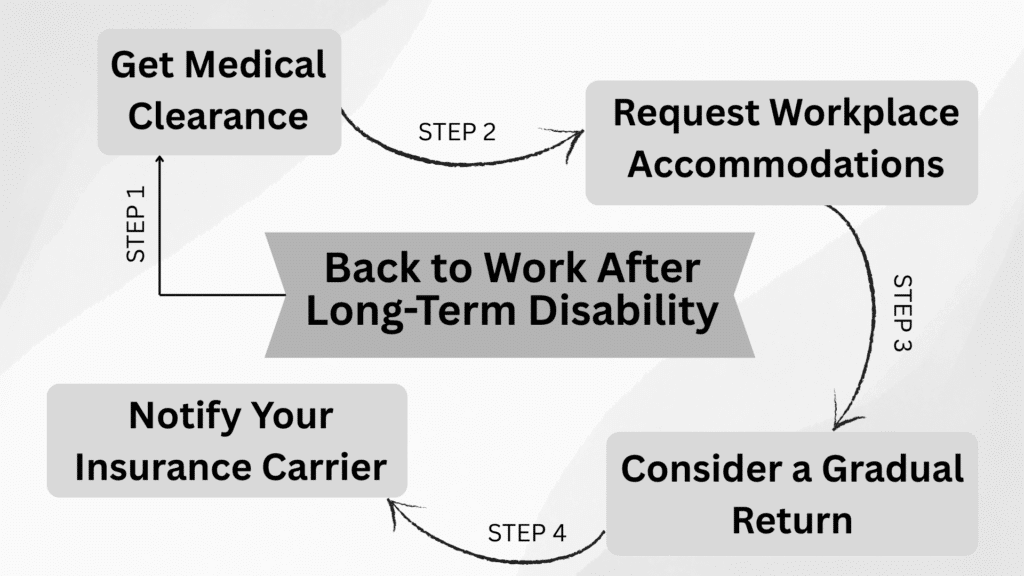

Transitioning back to work after long-term disability requires careful coordination with healthcare providers, employers, and insurance companies to ensure a successful and sustainable return.

Follow these essential steps to ensure a smooth settling back into the workplace:

- Get Medical Clearance: Obtain written clearance from your healthcare provider indicating your ability to return to work and any ongoing limitations.

- Request Workplace Accommodations: Work with HR to identify necessary workplace accommodations such as modified schedules, ergonomic equipment, or adjusted duties.

- Consider a Gradual Return: Many employers offer phased return-to-work programs that let you gradually increase hours and responsibilities.

- Notify Your Insurance Carrier: Notify your LTD insurance carrier about your return plans to understand how earnings affect your benefits.

Conclusion

Long-term disability through employer benefits & provides essential financial protection during serious health challenges.

Maximizing these benefits requires understanding your policy’s terms, maintaining open communication with managers, and knowing your legal rights under federal disability laws.

Take time to review your employer’s disability policies and discuss any questions with your HR department.

Being prepared now ensures you can make informed decisions when you need these benefits most.

Understanding the application process, eligibility requirements, and job protections empowers you to protect your financial future while focusing on recovery.

Have questions about your long-term disability coverage?

Share your concerns or experiences in the comments below.

Frequently Asked Questions

How Does LTD Affect My Retirement or Pension Contributions?

Most employer retirement plans suspend contributions during unpaid leave. Some plans allow voluntary contributions or provide service credit during disability leave. Check your plan documents and consult HR for specifics.

Can I Supplement My LTD with Other Insurance or Savings?

Yes, you can use personal savings or individual disability insurance to supplement LTD benefits. However, many policies reduce benefits if you receive income from sources like Social Security Disability Insurance. Review your policy terms for details.

What Happens if My LTD Claim Is Denied? Can I Appeal?

Yes, you can appeal denied claims by filing a written appeal within 180 days and providing additional medical evidence. Most policies require exhausting internal appeals before pursuing legal options.