Losing a job often comes with mixed emotions, anxiety about the future, and relief when severance pay softens the transition.

But while this payment provides temporary support, many employees feel uncertain about how it affects their taxes.

Severance pay taxation can seem confusing because it depends on how employers classify and process these payments under U.S. tax law.

Knowing the basics helps you anticipate your tax obligations and plan your finances confidently.

This post explains how severance pay is treated for tax purposes and how both federal and state rules can impact your final take-home pay.

Figuring out these essentials ensures you’re financially ready when employment changes unexpectedly.

Is Severance Pay Taxable?

Yes, Severance pay is taxable in the United States.

Severance pay is categorized as supplemental wages, meaning it is fully taxable in the year it’s received.

The IRS treats it the same as regular wages, which means it is included in your total income for the year and reported on your W-2.

Because it adds to your yearly earnings, part of the payment may be taxed at a higher marginal rate than usual.

Severance is also subject to payroll taxes and, in most states, state income tax.

Possessing the knowledge of these rules helps you estimate how much of the payment you will actually receive.

How is Severance Pay Taxed?

Severance pay is taxable just as ordinary income.

If it is issued as a separate payment, federal income tax is typically withheld at a flat 22% under the supplemental wage rules.

Severance, if combined with your final paycheck, employers may use your regular withholding rate for that pay period, leading to a higher deduction for that month.

Payroll taxes also apply to severance pay:

-

Social Security tax (6.2%) applies until total annual earnings reach $168,600, and severance counts toward this limit.

-

Medicare tax (1.45%) applies to all severance payments, with no income cap.

-

An extra 0.9% Medicare surtax applies if your yearly compensation exceeds $200,000.

Other deductions may also be taken:

-

Retirement contributions: Some employers permit pension contributions for a short time , which lowers the taxable part of the severance.

-

Health insurance premiums: If you continue coverage, such as through COBRA, premiums may be deducted from the severance according to your arrangement with the employer.

Employees can adjust their W-4 before payout to match deductions more accurately.

Payment Methods of Severance and Their Tax Effects

How severance is paid can influence both withholding and your income for the year.

Each method comes with different tax effects on your severance income.

1. Lump Sum Payment

When severance is paid in one large amount, the full payment is counted in the same tax year.

This can raise your total earnings and may cause part of the income to be taxed at a higher rate.

Employers may also withhold more tax immediately because of the higher payout.

2. Severance Paid With Your Final Paycheck

If the severance is combined with your last paycheck, both amounts are taxed together using your regular withholding rate.

This can increase withholding for that pay period, but does not change how the IRS taxes the income at year-end.

3. Severance Paid in Installments

When severance is spread over weeks or months, the smaller payments help keep your income steadier.

This may reduce the chance of moving into a higher bracket and can make withholding more predictable through the year.

4. Delayed Severance Payment

In some cases, severance can be shifted to the next calendar year.

This may lessen your tax burden if the following year has a lower income than the year of your job loss.

Handling Severance and Unemployment Benefits

Severance pay can affect when unemployment benefits begin and how your claim is processed.

-

Some states treat severance as continued wages, which can delay the start of unemployment benefits.

-

Other states treat severance as separate income, allowing benefits to begin without delay.

-

Reporting severance accurately helps prevent slow approvals, reduced weekly amounts, or later corrections.

-

Your eligibility may shift if severance raises your income for the year, depending on your state’s rules.

-

How your employer reports the payment can affect the timing of your claim, so keeping clear documentation helps avoid issues.

How U.S. States Deals with Severance Pay Taxation?

State tax rules differ, affecting how much of your severance income you take home.

Below is a summary of how key U.S. states handle severance pay taxation:

| State | State Income Tax Rate | Key Details |

|---|---|---|

| Texas | 0% No state individual income tax. | Severance pay is only subject to federal and FICA taxes. |

| Florida | 0% No state individual income tax. | Severance pay faces only federal withholding with no state deductions. |

| California | Progressive rates from 1% to 13.3%. | Severance is taxed as ordinary income, and higher payouts may reach top rates. |

| New York | Up to about 10.9% (state) plus local taxes, such as NYC, up to 3.876%. | Severance pay is taxable at both state and local levels where applicable. |

Find out more about taxes per state.

States like Texas or Florida impose no state income tax, while higher-tax states such as California and New York may withhold a larger portion.

Do All Employers Pay Severance Pay?

Not all employers are required to offer severance pay. In the U.S., severance is generally a company policy or part of an employment contract, not a federal legal obligation.

If a written agreement, union contract, or company handbook promises severance, employees have the right to enforce it.

In such cases, you can contact your HR department, review the company’s policy, or seek help from your state labor agency.

If severance was contractually guaranteed but not paid, consulting an employment attorney can help recover the amount through negotiation or legal action.

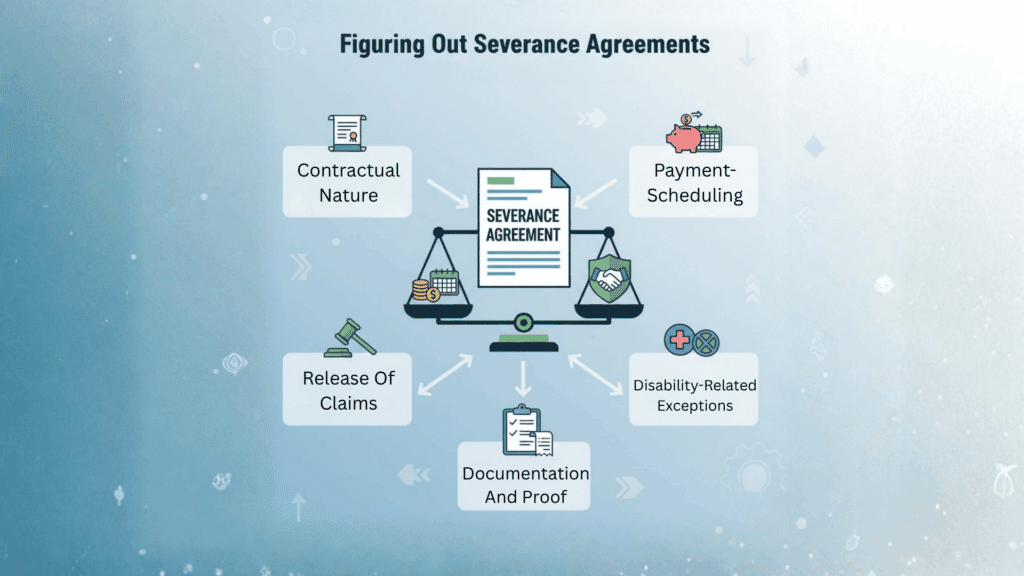

Figuring Out Severance Agreements

A severance agreement outlines your payment terms and any conditions after employment ends.

-

Contractual Nature: Details payment obligations, benefit continuation, and post-employment requirements.

-

Release of Claims: Many agreements include a clause waiving the right to pursue legal action in exchange for payment.

-

Disability-Related Exceptions: If tied to a work injury, up to $5,250 may be excluded from taxable income.

-

Documentation and Proof: Keep records of expenses related to the transition to support deductions when allowed.

Conclusion

Taxes, deductions, and benefits all play a part in how severance pay shapes your finances after job loss.

Apart from immediate relief, it’s a moment to think strategically about budgeting, savings, and future stability.

Planning for taxes early, reviewing agreements carefully, and managing withholdings can prevent confusion later.

Knowing how severance pay is taxed gives you an edge in protecting your income and preparing for what comes next.

Financial awareness during transition helps ensure you stay steady until your next opportunity arrives.

Share your experiences or tips about severance pay and taxes by writing them down in the comments below.

Frequently Asked Questions

Is It Better to Have Severance Paid in a Lump Sum?

Receiving severance in a lump sum offers quicker access to funds, but can raise annual taxable income and influence eligibility for certain financial benefits or unemployment payments.

What is Considered a Decent Severance Package?

A decent severance package usually includes one to two weeks of pay for each year of service, plus extended benefits or job transition support.

Is It Worth Negotiating a Severance Package?

Yes, negotiating a severance package is often worthwhile since it can improve payout terms, extend benefits, or secure better conditions for your transition