Could your employees be stealing more than just cash right under your nose?

Employee theft costs U.S. businesses billions of dollars every year, covering more than missing cash.

It includes stolen supplies, payroll fraud, and complex financial schemes that damage every type of organization.

Small shops risk bankruptcy, while large corporations lose reputation and trust.

Nonprofits also face stolen resources that should serve their missions.

This blog shares the real numbers behind theft, examples across industries, the legal charges involved, and practical strategies and methods to reduce risks.

What is Employee Theft?

Employee theft is the act of workers taking money, property, or resources from their employer without permission.

It can involve cash, merchandise, supplies, data, or even time.

Theft is not limited to lower-level staff; it can also be carried out by managers or executives who exploit their authority and access.

Unlike accidental loss or accounting errors, employee theft is intentional and violates the trust that businesses place in their workforce.

Types of Employee Theft

Employee theft can appear in several forms within the workplace.

Knowing these forms allows business owners to identify risks early and apply the right prevention steps..

Asset theft: Itinvolves stealing physical items like inventory, equipment, supplies, and cash. Employees pocket merchandise, take office equipment home, or steal customer payments.

Time theft: It means getting paid for hours not worked. This includes buddy punching, extended unreported breaks, and padding timesheets with false hours.

Payroll fraud: It targets payment systems through fake employees on payroll, false expense reports, or inflated overtime claims.

Data theft: It involves stealing customer lists, trade secrets, or financial records. Thieves often sell this information to competitors.

Financial fraud: It includes billing customers but keeping payments, tampering with checks, or falsifying financial reports.

What is Employee Theft in Management?

Management-level theft often causes greater damage due to authority and access.

Supervisors and executives can approve fake purchase orders or unnecessary contracts, and they may pressure subordinates to cooperate.

The damage goes beyond financial losses, as theft at the management level harms morale and erodes customer trust, sometimes for years.

Famous Employee Theft Cases

Several high-profile employee theft cases demonstrate the serious consequences of workplace crime.

The cases given below from across the United States show how theft gets exposed and what happens to the people involved.

Case 1: Former Boston Bank Teller

A former bank teller in Boston admitted to embezzling more than $180,000 from customer accounts over several years.

He forged names, manipulated withdrawals, and diverted funds for personal use.

The scheme unraveled after internal reviews revealed inconsistencies in account balances.

He pleaded guilty to embezzlement and aggravated identity theft and now faces sentencing under federal law.

This case highlights how financial institutions remain vulnerable when employees with account access abuse their authority.

Case Source: Department of Justice

Case 2: Wage Theft at Grimaldi’s Pizzeria, NYC

The owner and a manager of the well-known Grimaldi’s Pizzeria in New York City were charged with wage theft involving more than $20,000.

Investigators alleged that they withheld wages from multiple employees by failing to pay proper overtime and manipulating payroll records.

This misconduct left workers underpaid while the business benefited financially.

Prosecutors emphasized that wage theft is a form of employee exploitation that carries serious legal and reputational risks for restaurant owners.

Case Source: The New York Times

Case 3: Fake-Employee Payroll Scam at Wendy’s

In Lancaster County, Pennsylvania, a former Wendy’s manager created a fake employee in the payroll system to collect wages that were never earned.

By clocking in this nonexistent worker for multiple shifts, the manager funneled nearly $20,000 into their own pocket.

The scheme was uncovered when issues in scheduling and payroll were flagged.

Authorities charged the manager with theft and fraud, showing how even small-scale scams can have significant legal consequences for businesses and employees.

Case Source: PhillyVoice

Other Employee Theft Cases Examples

These examples show how employee theft happens across different industries.

EXAMPLE 1: A former Riverside Community Hospital employee in California was sentenced to six years in state prison for stealing medical supplies worth millions of dollars and reselling them.

Case Source: Riverside County Office of The District Attorney

EXAMPLE 2: A man who worked in hospitals in Washington State stole medical equipment (thermometers, probes, etc.) and sold them online; the stolen items from one hospital were valued at more than $108,000.

Case Source: Department of Justice

EXAMPLE 3: An employee of an IT asset disposal warehouse (Maryland/Virginia) admitted to stealing devices and reselling them.

Case Source: The London Times Mirror

EXAMPLE 4: A former medical supply/equipment wholesaler sales agent in Texas pleaded guilty to stealing and reselling pre-retail medical products.

Case Source: Department of Justice

Strategies to Prevent Employee Theft

Prevention works better than punishment when it comes to employee theft.

Smart business owners implement multiple layers of protection to reduce theft opportunities and catch problems early.

1. Strong Internal Controls

Strong internal controls form the backbone of theft prevention.

Duties should be separated so that no single employee manages every part of a financial transaction.

For example, the person who approves payments should not also process them.

Regular reviews of financial records and quick investigation of unusual patterns help identify problems early and reduce the risk of losses.

2. Regular Audits

Audits provide an essential layer of accountability.

Both scheduled and surprise audits of cash handling, payroll, and inventory help reveal irregularities before they become major issues.

In addition, bringing in outside auditors can provide fresh insights into vulnerabilities that internal teams may overlook.

This combination of internal and external checks creates a stronger safety net for businesses.

3. Physical Safeguards

Physical safeguards reduce theft opportunities by controlling access to valuable assets.

Security cameras placed in key areas such as cash registers, inventory storage rooms, and employee entrances serve as both a deterrent and a source of evidence.

High-value items should be secured with locks or safes, and access should be limited to only a small number of authorized employees.

These steps make it harder for theft to occur unnoticed.

4. Time-Tracking Systems

Time theft is one of the most common forms of workplace fraud.

Modern time-tracking systems help prevent this by requiring biometric verification, such as fingerprints or facial scans, to clock in.

GPS-based tracking for mobile workers ensures employees are actually present at job sites when reporting hours.

These tools give employers confidence in the accuracy of payroll data.

5. Background Checks

Background checks help reduce the risk of hiring employees with a history of theft or fraud.

Employers should verify references, review past employment, and check criminal records within legal limits.

While not every past issue should disqualify a candidate, extra caution is essential when filling roles that involve cash handling, payroll, or financial oversight.

Careful hiring reduces vulnerabilities before they enter the workplace.

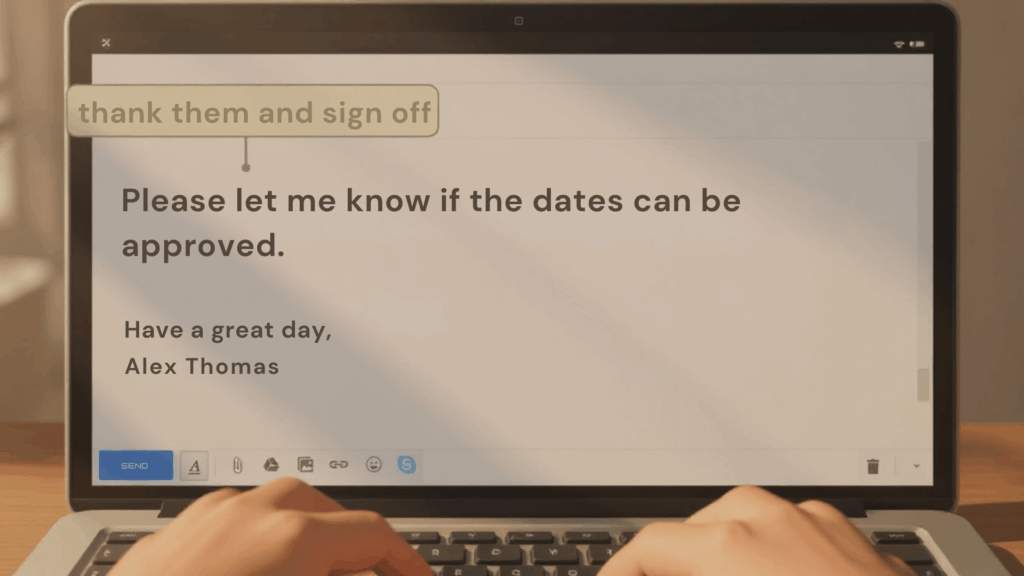

6. Anonymous Reporting Systems

Employees are often the first to notice suspicious activity.

Anonymous reporting systems, such as hotlines or secure online portals, give them a safe way to share concerns without fear of retaliation.

To be effective, all reports should be taken seriously, investigated promptly, and acted on when necessary.

This builds trust and encourages a culture of honesty.

7. Clear Policies

Written policies set clear expectations and consequences regarding theft and related misconduct.

Policies should cover conflicts of interest, handling of company resources, and the penalties for violations.

Employees should sign acknowledgments confirming they understand the rules, and refresher training should be offered regularly.

A consistent approach shows that the business is committed to fairness and transparency.

8. Inventory Management

Good inventory management makes it easier to identify theft quickly.

Regular physical counts should be compared with recorded figures, and any discrepancies should be investigated right away.

For higher-value items, tools like barcodes or RFID tags provide real-time tracking and accountability.

This system not only protects assets but also improves overall efficiency.

9. Financial Monitoring

Continuous financial monitoring helps detect irregular activity in payroll, expenses, or vendor transactions.

Automated alerts can be set up to flag payments above certain amounts or outside normal patterns.

Reviewing vendor lists regularly helps prevent unauthorized additions or duplicate records.

These measures create an early warning system for fraud that might otherwise go unnoticed.

Legal Charges for Employee Theft

When theft in the workplace is identified, legal charges depend on the details of the case and the value lost.

Being aware of these legal outcomes shows how severe workplace theft can be for both employers and employees.

-

Larceny: Federal law under 18 U.S.C. § 659 specifically addresses theft from interstate shipments. It involves the theft of cash, supplies, or inventory, with penalties depending on state laws and the value stolen.

-

Embezzlement: Applies when employees misuse funds or property they’re entrusted with. Governed by 18 U.S.C.§ 664, federal law applies to embezzlement from banks or government entities.

-

Fraud: Under 18 U.S.C. § 1341 (mail fraud) and 18 U.S.C. § 1343 (wire fraud), federal law handles financial deception, with states adding their own penalties. Involves schemes like fake invoices or manipulated financial records.

-

Federal penalties: Apply when theft involves interstate transactions or federal programs. 18 U.S.C. § 1343 addresses wire fraud, while 18 U.S.C. § 2314 covers transporting stolen goods across state lines.

Employee Theft Statistics

Statistics Source: Association of Certified Fraud Examiners

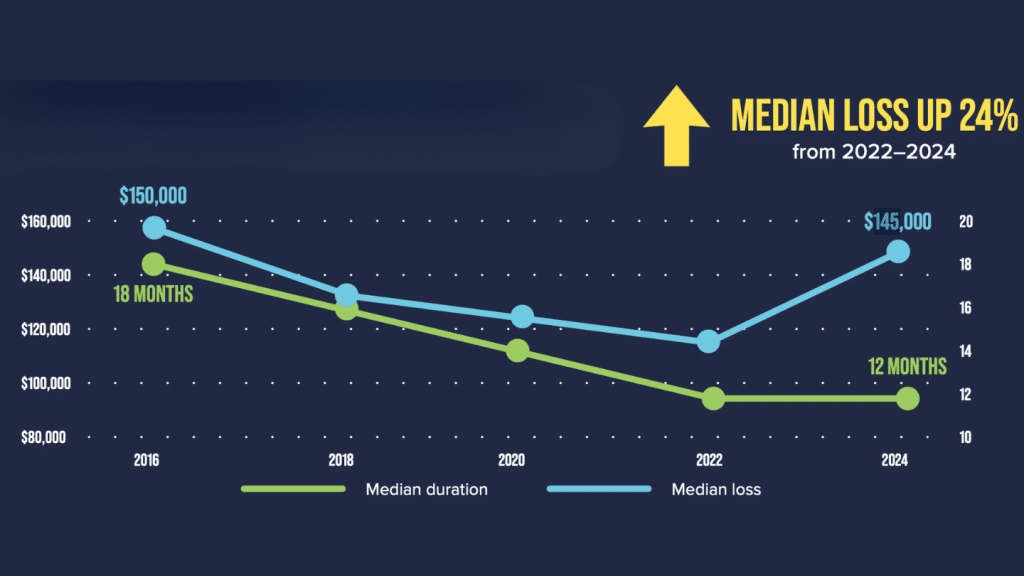

The 2024 ACFE Report to the Nations shows that organizations lose an estimated 5% of annual revenue to fraud, with a median loss of $145,000 per case.

Among the 1,921 cases studied, asset misappropriation was the most common, appearing in 89% of incidents, though it caused smaller losses of about $120,000 each.

Small businesses were especially vulnerable, with those employing fewer than 100 workers reporting a median loss of $141,000.

Industry data revealed the highest case numbers in banking and financial services (305), followed by manufacturing (175) and healthcare (117).

Challenges in Preventing Employee Theft

Even with strong safeguards in place, preventing theft is rarely straightforward.

Businesses often face practical, financial, and cultural barriers that can limit the effectiveness of prevention strategies.

-

Monitoring systems may raise privacy concerns and reduce trust if surveillance is excessive.

-

Prevention measures can be costly, especially for small businesses.

-

Poor investigations risk false accusations, harming morale, and creating legal exposure.

-

Remote work and digital tools create new theft risks, while outdated systems fail to detect issues.

-

Strict controls can make employees feel distrusted and lower morale.

-

Without consistent leadership support, even strong prevention programs often fail.

Conclusion

Employee theft is one of the most common internal risks businesses face, yet it often remains underestimated until the damage is done.

Beyond direct financial losses, it erodes workplace culture, reduces employee morale, and weakens customer trust.

The key to long-term protection lies in building awareness, reinforcing ethical values, and applying consistent oversight.

Companies that act proactively by addressing vulnerabilities, promoting transparency, and encouraging accountability.

Protecting assets isn’t just about avoiding loss; it’s about preserving trust and ensuring sustainable growth.

Frequently Asked Questions

What Industries Are Most at Risk for Employee Theft?

Retail and food service face the highest theft rates through cash and inventory losses, while healthcare and corporate offices see risks with supplies, payroll, and sensitive data misuse.

How Can Small Businesses Protect Themselves Against Employee Theft?

Small businesses can reduce risks with clear policies, regular cash counts, background checks, and anonymous reporting systems. Even low-cost measures help limit common theft opportunities and safeguard operations.

Is Employee Theft More Common with Remote or in-Office Work?

Both settings carry risks. Remote work often leads to time or expense fraud, while in-office environments face theft of cash, supplies, or inventory. Proper oversight is essential in both.

What Are the Early Warning Signs of Employee Theft?

Signs include cash discrepancies, missing inventory, resistance to audits, or sudden lifestyle changes. Consistent irregularities are stronger red flags than one-time issues and should be addressed promptly.